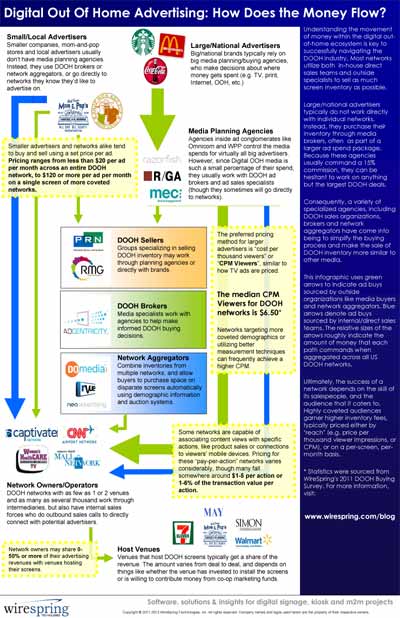

Behold the DOOH money flow infographic

This is basically my first try at any kind of infographic (aside from various charts and ecosystem diagrams), and I'm a bit ashamed to admit that I created it in PowerPoint. However, what it lacks in aesthetic appeal it hopefully makes up for in utility, since it's the first document of its kind that I'm aware of.

(Click the image above to see the full-size version, or download the PDF.)

What's going to happen to the aggregators, brokers and sellers?

It's no secret in our industry that the companies built specifically to serve DOOH networks are having a very hard time. In just the past few months, several DOOH aggregators (including some of the more prominent ones) have closed up shop, and I have no doubt that more will follow. However, taking those institutions out of the infographic literally leaves a big gaping hole in the middle -- and that's not just a design issue. As I see it, the problem is that these companies really do fill a need. Unfortunately, it's just not as big or well developed as their cost structures would have us believe. Thus, my prediction is that even if many of the intermediaries listed in the graphic disappear in the next 12 months, a new crop will necessarily come up to replace them. And even if that next batch fails, the process will be repeated until the industry's technology, logistic and business growth realities line up and make such firms viable. Until then, I don't think we're going to see anything more than the anemic fits-and-starts growth that has characterized the DOOH industry in the past.

How did the infographic come to be?

The general "shape" of the graphic is based on numerous conversations with customers, partners and colleagues, none of whom seem to really know how this stuff all goes together outside of their own direct experiences (and all of whom were quite ready to admit that fact). The market statistics were sourced from our own survey on how people buy and sell DOOH advertising, the results of which were published in a series of blog articles:

- DOOH Ads Sell for Average CPM of $12: Survey

- DOOH Media Buyers and Sellers Prefer Reach-Based Pricing: Survey

- DOOH Networks Slow to Adopt Pay-Per-Action Pricing: Survey

- DOOH Ad Pricing Varies Widely on a Per-Spot Basis: Survey

- How Many Ads Do You Need to Sell to Keep a DOOH Network Afloat?

Does the DOOH money flow infographic reflect reality? Do we need to make any changes? Do you have data that you'd like to contribute? Leave a comment and let us know! (Email/RSS subscribers, click through to /blog to comment.)

Subscribe to the Digital Signage Insider RSS feed

Subscribe to the Digital Signage Insider RSS feed

Comments

RSS feed for comments to this post