Early bellwether deals

Back in 2005, we were stunned when Thomson (now Technicolor) bought PRN for $285M. At the time, it was the largest deal our industry had seen, and over 7 years later I think that still might be the case. In 2006, it was equally amazing to see tiny digital signage software company Wireless Ronin go public on the NASDAQ exchange and soon have its shares trading at $10, giving the company a $70M valuation on gross sales of just a few million dollars.

I mention these deals not necessarily because they were the biggest or the best, but because they represented a time when digital signage was thought of as a strategic benefit for forward-looking companies. For me, a strategic deal is a deal in which the newly-merged entity is in some way greater than the sum of its original parts. From the buyer's perspective, this is good since it opens up new markets, exposes them to new opportunities, and otherwise allows them to grow in a way they previously could not. From the seller's perspective, this is good since they are able to get top-dollar for their firm -- or what I call a "strategic valuation" -- calculated based on the strategic value of the asset, not simply some multiple of sales or earnings.

What does the landscape look like today?

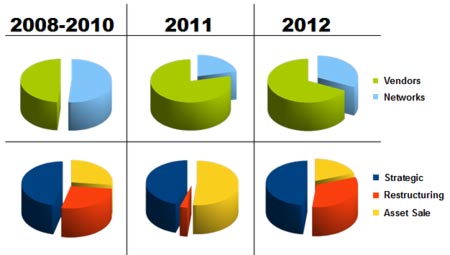

We've written two articles in the past that simply attempted to list out all of the relevant deals in our space. At first glance, the transactions on our 2008-2010 M&A list and our 2011 M&A list look impressive. For example, from 2008-2010 there were roughly 42 high profile deals in our space, but in 2011 alone there were 33 and as of October there were already 32 in 2012. From a pure numbers perspective, that seems like a lot. However, upon taking a deeper look, many of these deals were done by unhealthy companies who had little option but to do something -- anything -- or go out of business. In fact, when we recategorized the deals by type, we found that most fell into one of three categories: strategic deal (as defined above), asset sale (where the company is no longer operating, but has IP or hard assets that another firm purchases), and restructuring (includes private equity raises, recapitalization and bankruptcy restructuring). Separating the deals out into these categories gives a better picture of what the deal flow in our industry has really looked like:

In short, from 2008-2010 there were 42 "high profile" deals, 19 of which had some apparent strategic value to the buyer. 50% were network-centric, 50% were vendor-centric. However, of those 19 strategic deals, 10 were deals of necessity, making "true" strategic acquisitions of healthy companies account for less than 25% of high-profile dealflow. In 2011, we noted 33 "high profile" deals, of which 15 had some apparent strategic value. Once again, the majority (9 of 15) were deals of necessity rather than deals of strength. And in a shift from previous years, most of the deals (78%) were vendor-centric, rather than related to DOOH network owners or operators. That trend continued in 2012, where noted 32 relevant deals so far, 15 of which were strategic. Once again, the majority (8) were deals of necessity.

While some acquirers have tried to think strategically over the last 5 years, most have been merely opportunistic, tucking in small companies who have fallen on hard times, or purchasing the assets of the many who couldn't quite make it. PE firms have continued to invest funds, but the money has primarily gone to existing portfolio companies. The net result is that very few deals in our space create entities that are greater than the sum of their parts.

Taken from another perspective, it seems likely that many vendors, who generally can't just "scale up" to boost profits, started to peter out in the second half of last decade. With commoditization and a vicious race-to-the-bottom in play, many of the 600+ started looking for a way out, many of them much too late. Companies that are so far gone as to look for mergers or acquisitions of necessity don't do well at the bargaining table, but they might be the lucky ones. A cursory look around the industry suggests that there will be more to come, and with interested buyers already having made their acquisitions, this will probably translate to more simple wind-downs and bankruptcies.

What can be done?

At this point in the market cycle, DOOH network owners and digital signage vendors are unfortunately left with big, scary choices if they still want to achieve a successful exit at a maximal valuation. For DOOH network owners, we feel that the biggest chance for success comes from building scale early on, and as quickly and continuously as can be practically maintained. In other words, if there's cheap money out there, use it to build front-loaded scale. For digital signage vendors and ecosystem players, the quest to find a strategic buyer will likely only be fruitful if you identify a growth niche where your technology plays and focus 100% of your efforts on it (unless you really think you have sufficient resources to pursue a dual-path, I suppose). For all parties, we recommend that you of course keep primary business objectives front-of-mind, but don't lose sight of what potential acquirers might be interested in.

What's to come?

I hate making predictions, because they always end up being wrong to some extent or another. But I know people love reading them, so here are 5 that I think are reasonable for the near-term:

- For firms that are financially solid but continue to play primarily in the "vanilla" digital signage space, it will continue to be a buyer's market for some time to come.

- Those companies meeting the minimum revenue and EBITDA requirements of private equity firms (say, $5M gross and $1M net) may not have trouble finding buyers, but also may not be thrilled with the prices being offered.

- For network owners, workflow and customer agreements will be second only to earnings for getting the attention of potential buyers.

- For vendors, IP assets will play a bigger role -- but only when the potential acquirers are large companies.

- There will be more consolidation -- and overall, the deal flow will probably continue to look like it has for the past few years.

Subscribe to the Digital Signage Insider RSS feed

Subscribe to the Digital Signage Insider RSS feed

Comments

RSS feed for comments to this post